Running a small business without a financial plan is like navigating without a map—you might move forward, but not in the right direction. Many small business owners focus on sales, marketing, or operations while overlooking the critical need for structured financial planning.

Without a financial plan, you risk poor cash flow, missed growth opportunities, or even business failure. This article outlines four essential steps to create a financial plan that supports stability, scalability, and strategic decision-making.

Abstract: Financial Planning for Small Business Success

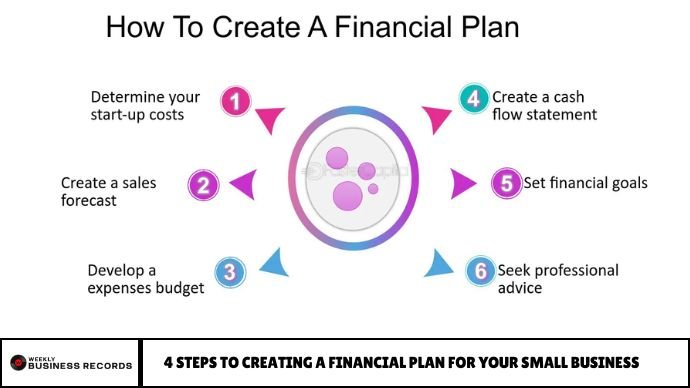

Creating a financial plan for your small business helps you set realistic goals, manage cash flow, project expenses, and secure funding. In this guide, you’ll learn the four key steps to building a solid financial roadmap that empowers smarter decisions, improves sustainability, and positions your business for growth.

1. Set Clear Financial Goals

Before diving into numbers, you need to define what success looks like for your business.

Start by identifying short-term and long-term goals:

- Increase monthly revenue by 20% in the next 12 months

- Launch a new product line within six months

- Reduce operating expenses by 10% this year

- Expand into a new market by Q4

Use SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound—to stay focused and track progress effectively.

Why it matters:

Clear goals give your financial plan structure and help determine how to allocate resources.

2. Create Financial Projections

Once you have goals, build projections to estimate your business’s financial future. These are typically broken into three statements:

Income Statement (Profit & Loss)

Shows your revenue, costs, and profits over a period.

Use it to:

- Forecast monthly/quarterly sales

- Track profitability trends

Cash Flow Statement

Details the inflow and outflow of cash.

Use it to:

- Ensure you can cover expenses

- Avoid cash shortages during slow seasons

Balance Sheet

Summarizes assets, liabilities, and equity at a specific point.

Use it to:

- Monitor financial health

- Evaluate solvency and borrowing ability

Statistic:

According to SCORE, 82% of small business failures are due to poor cash flow management—making this step vital.

3. Budget and Track Spending

A good financial plan includes a realistic, flexible budget. This keeps you grounded in what your business can afford and prevents overspending.

To create a budget:

- Estimate fixed and variable costs (e.g., rent, payroll, supplies)

- Categorize spending by department or activity

- Allocate funds to each area based on priority

Regularly track actual spending against your budget and adjust as necessary. Even small variances can reveal important trends or inefficiencies.

Tip: Use accounting tools like QuickBooks or spreadsheets to monitor performance monthly.

4. Plan for Funding and Financial Risks

Every business needs capital and contingency planning. Whether you’re bootstrapping, seeking investors, or applying for a loan, you must know how much funding you need—and why.

Include in your plan:

- Start-up or expansion capital needs

- Loan repayment schedules

- Emergency reserve for 3–6 months of expenses

- Risk mitigation plans (e.g., rising costs, delayed payments)

Investor-ready:

A solid financial plan can help you secure funding by demonstrating professionalism and potential.

FAQs

1. Why does my small business need a financial plan?

It helps you set goals, track performance, avoid cash shortages, and prepare for growth or funding opportunities.

2. How often should I update my financial plan?

Review it quarterly or whenever your business undergoes significant changes, such as a new product launch or funding round.

3. What is the most important part of a financial plan?

Cash flow management—it ensures your business can meet obligations and operate smoothly.

4. Do I need accounting software to create a financial plan?

No, but tools like QuickBooks, Xero, or Excel can simplify tracking and improve accuracy.

5. Can I create a financial plan myself?

Yes, especially for smaller businesses. However, consulting a financial advisor can provide added insight and strategy.

6. What if my projections are off?

That’s normal—projections are estimates. Regular updates and tracking help keep your plan realistic and actionable.

Conclusion

A financial plan isn’t just paperwork—it’s a blueprint for your small business’s future. By setting clear goals, projecting income and expenses, budgeting wisely, and planning for risk, you lay the groundwork for sustainable growth.